When not to trade

"It's not me, it's the market!". A phrase you've probably uttered many times before and probably most times it's spoken out of frustration because your trades aren't coming off and you're losing money.

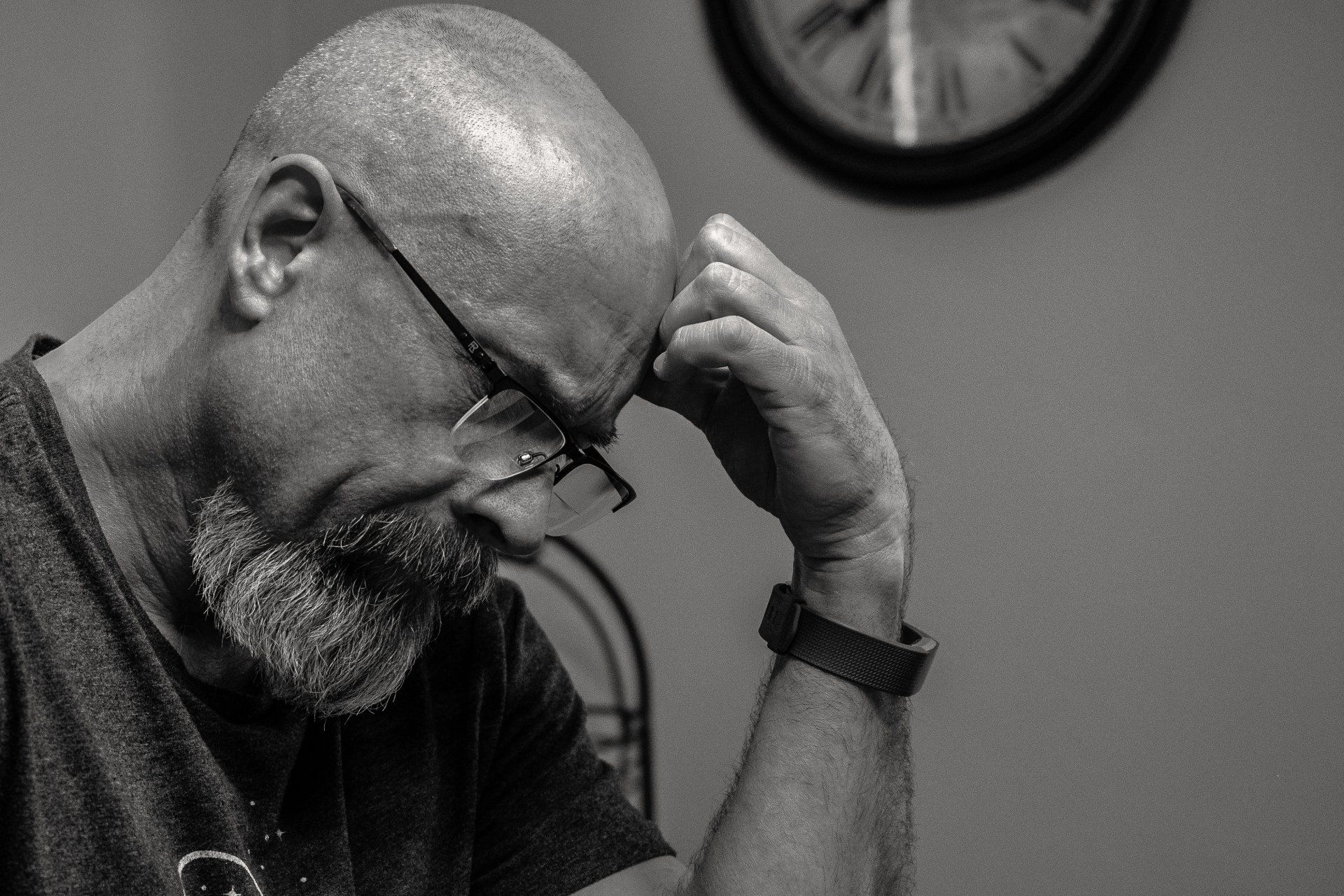

But when go back and dissect the trades you took, you find out it often is you. It could be down to impatience because you didn't wait for the right trade set-up and/or you jumped in too early. Or it could be down to adrenaline because you're seeing trades that aren't there or you are closing trades down too soon. Successful trading requires full control of your emotions and because we're humans we sometimes lapse!

Sometimes though, it is the market. Some days the markets are just too choppy or rangebound to suit your style of trading. We've traded for many years and in our view you get a 7 good days trading, 14 average days trading and 7 bad days trading every month. Now that would be great if the days were clearly signalled and all bundled together. Unfortunately they're not. You can have a great day followed by a bad day followed by an average day, followed by another bad day etc. etc.

Recognising when the market conditions change will stop you losing money; this is the time when you just need to walk away. No single trading system or technique will work in all market conditions, the banks will tell you that.

So what do you do, how do you know when to get into the water and when to stay out? Well you can look at lots of fancy indicators which have the tendency to confuse you even further or, like us, you can just focus on the basics of support/resistance and targets.

Those invisible lines of support and resistance are telling you where the market wants to get to and what is stopping it from getting there. These are the two most important factors in trading. They give you the momentum, direction, strength and maximum possible excursion of a trade. There are many basic tools out there (SMAs, Bollinger Bands etc.) that can give you an idea of these lines. Inteligex uses its proprietary technology to give multiple levels of support and resistance in addition to target cribs showing you where the market is trying to get to. This means you have a simple way of seeing the potential strength and size of a trade.

If you are looking at the S&P and the target crib is telling you that your maximum possible excursion is only averaging a couple of points then it is too tight to trade. If the lines of support and resistance are running horizontally with minimal angles then momentum is low and you're not going to get big moves in either direction. If your chosen index has just passed through a line of support then the next line is showing you the subsequent logical stopping point.

A system like Inteligex which gives you lines of support and resistance and maximum excursions makes it easy to see when your trading will have a lower probability of success. These are the times when you should just pack up and walk away my friends. Maybe come back and take a look later in the day or wait until the following day.

What's critical is that you keep your emotions in check, so you need to make sure you "play yourself in". What does that mean? Well it means settle yourself in gently. If you're a baseball player facing the first pitch of the day you don't just swing wildly at it, you watch the pitcher, watch the arc of the ball and tune in your senses. Getting ready for trading should be exactly the same: get yourself ready for the day and when the market opens just watch and get a feel for the market. Wait for it to settle down and watch what it is doing. Imagine yourself has a hunter, when the prey is in the perfect position then strike, the trades will come to you!

To see how you could become a winning trader, book your FREE Personal Consultation.

USEFUL LINKS: What is the Fed, Risk and Reward, The end of Cheap Money, What is Artificial Intelligence, Tech Stock Rebound, Banking Crisis, Common Trading Mistakes, What is a Recession, What is Fiscal Policy, What is Monetary Policy, Why are Economic Forecasts Wrong, US Stocks in 2023, Your best shot at Goal, Learn to Earn, Looking for a good stock to buy, What is Inflation?, How interest rates work